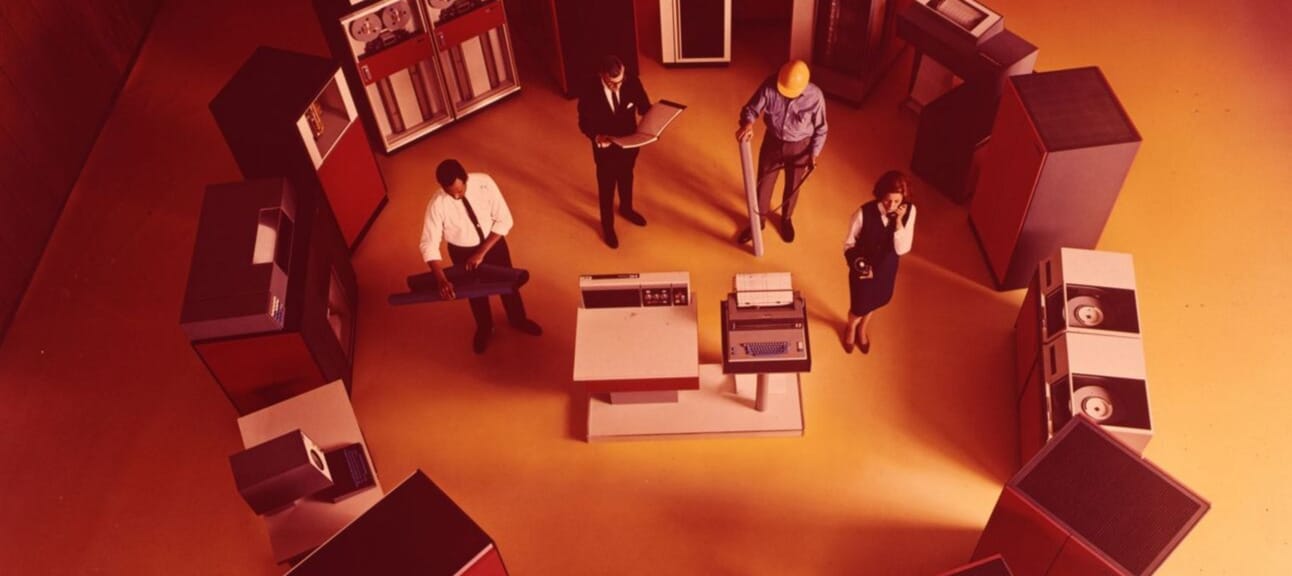

System/360, from a 1964 sales brochure

While most investors were watching Bitcoin's price action, a quiet shift was unfolding in corporate boardrooms and government treasuries worldwide.

From MicroStrategy's $17 billion Bitcoin playbook to Solana's DeFi ecosystem generating 4x Ethereum's application revenue, the crypto landscape is experiencing a fundamental shift that's reshaping how we think about value, attention, and the future of finance itself.

In today's issue, we're diving deep into the corporate Bitcoin treasury trend that's attracted 40+ companies and billions in capital, exploring why traditional valuation models are failing Layer 1 tokens, and uncovering how platforms are literally financializing your attention through InfoFi.

Whether you're tracking institutional adoption, hunting for the next DeFi gem, or positioning for the tokenization wave, today's insights will help you navigate the opportunities—and risks—that are defining crypto's next phase.

As always, send us feedback at [email protected].

Bitcoin on the Balance Sheet: How Corporates and Governments Are Reshaping Treasury Strategy

A growing wave of corporations and even governments are transforming their treasury management by adding Bitcoin $BTC.X ( ▲ 0.48% ) to their balance sheets. Sparked by MicroStrategy’s bold moves and Michael Saylor’s advocacy, this trend now includes a diverse roster of public companies (like MetaPlanet, Trump Media, and TwentyOne) and sovereign entities (such as Finland, the US, and China).

40+ companies have raised $17B in capital for Bitcoin treasury strategies in 2024 alone.

These players aren’t just buying Bitcoin—they’re leveraging advanced financial engineering, including convertible bonds and premium equity offerings, to amplify returns and generate what Saylor dubs 'BTC yield.'

The flywheel for MicroStrategy is that positive growth in Bitcoin per share, or colloquially call it BTC yield in the strategy and investor circles.

This shift is fueled by the search for a non-sovereign store of value amid inflation and fiscal uncertainty, the growing legitimacy of Bitcoin through ETFs and institutional adoption, and the innovative 'reverse tokenization' thesis, which positions public companies as new gateways for capital into Bitcoin. While this strategy introduces new risks—such as increased leverage and potential systemic vulnerabilities—it’s undeniably reshaping the Bitcoin landscape, driving both price momentum and heightened volatility.

As capital allocators turn to Bitcoin for resilience in uncertain times, staying informed across domains—from markets to geopolitics—has never been more critical.

Daily News for Curious Minds

Be the smartest person in the room by reading 1440! Dive into 1440, where 4 million Americans find their daily, fact-based news fix. We navigate through 100+ sources to deliver a comprehensive roundup from every corner of the internet – politics, global events, business, and culture, all in a quick, 5-minute newsletter. It's completely free and devoid of bias or political influence, ensuring you get the facts straight. Subscribe to 1440 today.

Cracking the Code: How to Value Layer 1 Tokens in a Changing Crypto Landscape

Valuing Layer 1 tokens like ETH $ETH.X ( ▼ 2.26% ) , SOL $SOL.X ( ▲ 1.18% ) , and SUI $SUI.X ( ▲ 4.05% ) is one of crypto’s most contentious and consequential debates. Traditional models like discounted cash flow (DCF) fall short because L1s generate native token rewards rather than external cash flows, prompting the rise of new metrics such as REV (revenue from fees and MEV) and RSOV (realized store of value).

If you want to value these things, you need a new framework. DCF doesn’t work for L1 tokens.

Solana’s application revenue is 4x higher than Ethereum’s over the past year.

Thought leaders are split: some see L1s as 'money' best valued by their store of value, while others argue for a blend of metrics or warn that fee-based revenues will diminish as blockspace becomes abundant. This ongoing debate shapes not only academic theory but also real-world investment strategies and the future viability of L1 ecosystems.

Solana DeFi Surge: How the Chain is Outpacing Ethereum and Redefining Crypto Innovation

Solana is rapidly establishing itself as the leading force among non-Bitcoin, non-Ethereum blockchains, with its DeFi ecosystem experiencing unprecedented growth in revenue, developer engagement, and user adoption.

Solana's stablecoin supply grew from $3B to $12B in 2024.

Over the past year, Solana’s application revenue has soared to four times that of Ethereum, fueled by a vibrant mix of meme coin trading and next-generation DeFi protocols like Jupiter $JUP.X ( ▼ 3.55% ) , Raydium $RAY.X ( ▲ 0.44% ) , Drift $DRIFT.X ( ▲ 1.42% ) , and Kamino $KMNO.X ( ▼ 0.71% ) . The stablecoin supply on Solana has quadrupled to $12B in 2024, and the network is attracting more developers than Ethereum.

What truly differentiates Solana is its relentless focus on user experience, innovative business models, and a startup-driven culture. Founders are laser-focused on product-market fit and sustainable revenue, drawing both retail and institutional capital. While meme coins have catalyzed much of the recent activity, the ecosystem is maturing with a shift toward robust DeFi primitives and real-world applications such as tokenized securities and private credit.

Despite these advances, challenges persist: high fully diluted valuations, cyclical market dynamics, and regulatory uncertainties. Yet, the prevailing sentiment is that Solana DeFi is not just a passing trend—it’s a transformative opportunity for investors ready to look beyond the traditional crypto giants.

Crypto is witnessing a transformative shift as platforms like Kaito, Cookie, and StayLoud pioneer the financialization of attention and social capital—what’s now being called InfoFi. These projects reward influencers, KOLs, and everyday users for generating buzz and engagement, sometimes distributing six-figure airdrops to top participants and capturing a significant share of Crypto Twitter’s attention in a single day.

Some campaigns have 25%+ of Cryto Twitter mindshare in a single day.

Kaito is a way of measuring attention. If you figure out how to tap into that and utilize it, I think it’s going to be pretty incredible.

By directly incentivizing attention and engagement, InfoFi platforms are creating innovative marketing, loyalty, and distribution channels. This trend has sparked both excitement—thanks to new revenue-sharing models and loyalty programs—and controversy, with concerns about sustainability, regulatory risk, and whether these incentives truly create lasting value. As InfoFi continues to evolve, investors and builders should closely watch how these platforms balance innovation with risk, and how they might shape the future of user onboarding, product launches, and mainstream adoption in crypto.

Stablecoins & Real-World Asset Tokenization: The Next Crypto Revolution

Stablecoins like USDC and Tether have emerged as crypto’s most widely adopted use case, powering payments, remittances, and DeFi. Now, the tokenization of real-world assets (RWAs)—from treasuries and equities to gold—is poised to unlock even greater value, attracting attention from both crypto natives and traditional finance giants. With Circle’s anticipated IPO and WisdomTree’s foray into tokenized assets, institutional interest is surging.

WisdomTree has $119B AUM, $2B in crypto ETPs, $150M in tokenized assets.

I’m very bullish on tokenization on the blockchain as the next wrapper of the future beyond ETFs.

Tokenization offers unique advantages over ETFs, including programmability, 24/7 trading, and composability, potentially democratizing access to previously illiquid or exclusive assets. As regulatory clarity improves, expect rapid innovation and integration of stablecoins and RWAs across DeFi and mainstream finance. Stay tuned for new product launches, evolving policies, and the expanding role of tokenized assets in reshaping global markets.

As we've explored today, we're witnessing a convergence of forces that's fundamentally reshaping the financial landscape: corporate treasuries embracing Bitcoin as a strategic asset, Solana's DeFi ecosystem outpacing Ethereum in revenue generation, attention itself becoming a tradeable commodity through InfoFi, and the tokenization of real-world assets bridging traditional finance with crypto innovation. Meanwhile, the intersection of AI and decentralized systems presents both unprecedented opportunities and existential questions about how we'll distribute power and prosperity in an age of artificial intelligence.

These aren't distant trends—they're happening right now, with billions in capital flowing, new protocols launching weekly, and regulatory frameworks evolving in real-time. The companies, protocols, and investment strategies that emerge victorious from this transformation will likely be those that best understand and adapt to these shifting dynamics.

Which of these trends do you think will have the most profound impact on crypto's trajectory over the next 12 months—corporate Bitcoin adoption, the Solana DeFi surge, InfoFi's attention markets, or RWA tokenization?

What do you think of today's newsletter?

Disclaimer: The information provided in this newsletter is for informational purposes only and should not be considered investment advice. Cryptocurrency investments are speculative and involve significant risk. Please conduct your own research and consult with a financial professional before making any investment decisions.