The Winter Test: When Markets Separate Signal from Noise

Good morning, crypto investors. Today we're witnessing one of those defining moments that reveal who's actually been building for the long term versus who's been riding the wave.

As Bitcoin tests the resolve of $65,000 support and over $1.4 billion evaporates in a single trading session, the familiar dance between fear and opportunity is reaching a crescendo. While retail traders scramble for exits and the Fear and Greed Index plunges to an icy 11, institutional players are quietly making moves that could reshape the entire landscape—with tokenized assets now commanding over $30 billion and major banks finally moving beyond pilot programs.

The question isn't whether this volatility will pass (it always does), but rather how you'll position yourself while others lose their nerve. Today, we're diving deep into the technical levels that matter, the institutional capital that's still flowing despite the chaos, and why seasoned traders are viewing this correction as validation, not vindication, of crypto's four-year cycle patterns.

A quick note for readers thinking ahead to compliance and reporting: I’ve put together a concise crypto tax guide that walks through common scenarios, pitfalls, and what actually matters come filing season.

→ view the guide

The Future of Tech. One Daily News Briefing.

AI is moving faster than any other technology cycle in history. New models. New tools. New claims. New noise.

Most people feel like they’re behind. But the people that don’t, aren’t smarter. They’re just better informed.

Forward Future is a daily news briefing for people who want clarity, not hype. In one concise newsletter each day, you’ll get the most important AI and tech developments, learn why they matter, and what they signal about what’s coming next.

We cover real product launches, model updates, policy shifts, and industry moves shaping how AI actually gets built, adopted, and regulated. Written for operators, builders, leaders, and anyone who wants to sound sharp when AI comes up in the meeting.

It takes about five minutes to read, but the edge lasts all day.

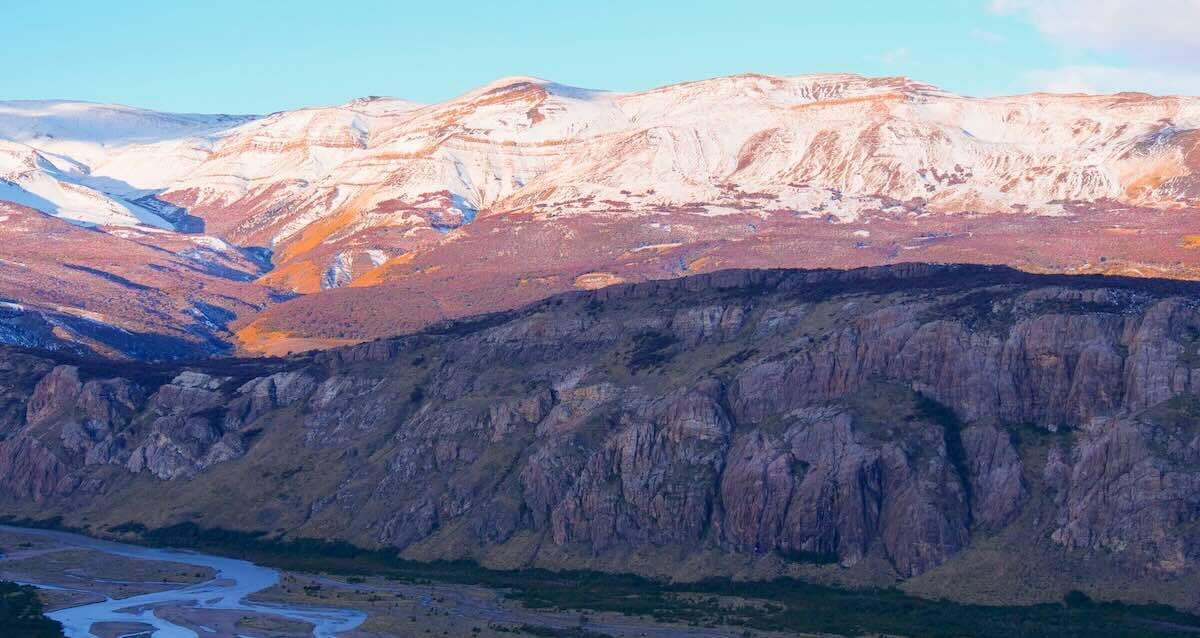

Frost and Fortune — Bitcoin’s Crackling Midwinter Paradox

The market’s patience is being tested as Bitcoin $BTC ( ▲ 11.81% ) slips beneath $65,000, pressing investors to reconsider what conviction looks like in unforgiving weather.

More than $1.4 billion in crypto liquidations in just one session signals a market leaning hard into risk aversion, while the Bitcoin Fear and Greed Index’s 11—deep in the red—serves as a statistical counterpoint to the recent euphoria. For Katie Stockton of Fairlead Strategies, technical discipline trumps emotion: “We want to keep trends on our side.” Her models show major support clustered between $60,000 and $70,000, with Ichimoku clouds and moving averages offering cold comfort in the scramble for footing.

Galaxy Trading’s $GLXY ( ▲ 17.34% ) Beimnet Abebe points to tightening macro conditions as another lever: as coordinated monetary tightening and fiscal wonkery apply pressure, “the swings in both directions are going to be violent.” This crosswind is compounded by equities correlation, turning Bitcoin’s winter into a broader market chill. For veteran traders like Simply Bitcoin’s Nico, history is ultimately an anchor: “The four-year cycle is intact... Bitcoin tends to correct about 80 to 75% in bear markets.” Seasoned holders are using the convulsion to quietly accumulate, wagering on the law of averages over short-term panic.

Market structure is resetting, not retreating—signaling that capital is waiting, not fleeing. Bitcoin’s volatility now acts as a global barometer for investor risk—and the threshold for conviction is climbing.

Capital Convictions — Institutions Find Their Footing in Crypto

The world’s most entrenched financial players are no longer circling crypto—they’re setting up shop.

After years of tentative probes, institutional capital is making itself unmistakable on-chain. Tokenized assets now eclipse $30 billion, with BlackRock, Fidelity, and JPMorgan championing pilot programs that convert everything from bonds to funds into digital-native wrappers. “We’re gonna take those ETF shares and turn them into tokens… improving your diversification,” says Ric Edelman, emblematic of the rising chorus predicting tokenization will soon outpace traditional ETF growth.

But the optimism is hardly unbridled. Scott Lucas of JPMorgan offers a measured assessment: blockchain may be a superior technology, but the road to interoperable, compliant infrastructure cuts through a tangle of regulatory and operational challenges. “There’s a good thesis to suggest that blockchain is a better technology… but there’s no evidence yet.” The $120 billion in annual savings banks might unlock with these platforms remains, for now, a north star—ambitious, not guaranteed.

Coinbase $COIN ( ▲ 13.0% ) , meanwhile, positions itself as a connective tissue, linking institutional flows with liquidity—institutional assets under custody now top $500 billion. “Volatility creates opportunity,” notes Brian Foster, gesturing to the capital formation strategies and stablecoin rails underpinning this transition.

Institutional entry is neither monolithic nor linear, but the inflection is underway. Crypto’s next phase will be defined not by retail exuberance, but by the measured resolve—and sizable balance sheets—of legacy finance.

Worth Exploring

The Milk Road Show - Dive into the transformative conversation about how traditional financial institutions are stealthily migrating on-chain, and why this seismic shift could redefine your understanding of crypto’s future.

CoinDesk - Discover why Deutsche Bank believes Bitcoin's latest selloff signals a critical 'reset' rather than a market breakdown, and how this perspective can reshape investor strategies amidst turbulent times.

The Block - Unpack JPMorgan’s intriguing forecast that positions Bitcoin as a potential powerhouse against gold, and learn the foundational shifts that could drive institutional interest in Bitcoin beyond the current market chaos.

Cointelegraph - Explore U.S. Treasury Secretary Scott Bessent's insights on the impending convergence of banking and crypto, shedding light on how regulatory frameworks could reshape your access to digital assets.

Enjoy Meridian? Forward today’s issue to a friend or colleague who follows crypto markets.

What do you think of today's newsletter?

Disclaimer: The information provided in this newsletter is for informational purposes only and should not be considered investment advice. Cryptocurrency investments are speculative and involve significant risk. Please conduct your own research and consult with a financial professional before making any investment decisions.